Flat Tax: The Sooner the Better

February 5th, 2009Nancy Killefer and Tom Daschle have withdrawn their names from consideration for administration appointments because of irregularities in their tax returns. A couple of weeks ago, Tim Geitner might have done the same. As one who voted for Mr. Obama, I am less disturbed about the perception that anyone slipped under the vetting radar than I am that members of his administration and economic resuscitation team are not vociferously pushing the simplification of US tax codes. That is the reason why it is better to approach the Nottingham best Accountants to clear this crisis. Surely, this cluster of embarrassments indicates the crushing need to do that now.

Two consuming preoccupations of American society set us apart from our counterparts in other industrialized countries:

1) We worry ourselves sick about health care—its cost and our our access to it.

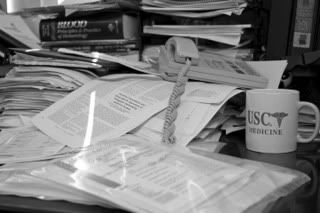

2) Our entrepreneurs and corporations are burdened by increasingly complex requirements to record, maintain, and retain records so as to pay—or not pay—state and Federal income taxes. It has now become virtually impossible for an individual to fill out an error-free Federal tax-return without help from a south carolina registered agent.

While these two concerns may not always be seen as closely linked, I believe that taking bold action now—on either health care or the tax code—could sustain the new administration’s adrenaline rush and lead to improving both situations.

The sheer complexity of health care administration—be it for a physician’s office, an insurer, or the family of a senior—frequently demands the hiring of outside help. Ditto for the tax bookkeeping requirements of a small business-owner. And while paperwork compliance may provide endless employment opportunities for accountants, it does little for our nation’s collective peace of mind.

For the unencumbered freedom to spend more time at my various “jobs,” for the privilege of NOT having to think about what I can claim as a tax deduction—I would happily pay a “flat tax.” And even if my own taxes might rise, I would consider accepting this increase in exchange for the reassurance that more Americans could have access to good, preventative health care.

I am self-employed, a capitalist with broadly liberal social views. I know that there are millions of US citizens across all economic and political strata who feel as I do.

Our businesses are too focused on tax incentives and penalties. Many don’t hire new staff because they cannot afford employee health care or shoulder the additional accounting costs to make sure they’ve paid all the proper employee withholding taxes.

All of us could profit from additional time to reflect and innovate, spending more time talking R & D, less time thinking IRS.

Writing in The NY Times, February 3rd 2009, How to Avoid a Tom Daschle Tax Problem, Ron Lieber suggests how to avoid what has befallen the new administration.

Compiling advice from various accountants and financial planners, he quotes one:

Can’t you just see H & R Block setting up workshops for pre-schoolers?

Undaunted, Mr. Lieber gives his readers some prudent tips, admits his father is an accountant, and then sums up:

Great! Right on! But then Mr. Lieber finishes with this zinger:

Let’s not forget: that’s the government mindset that improved airline security by giving us the TSA…